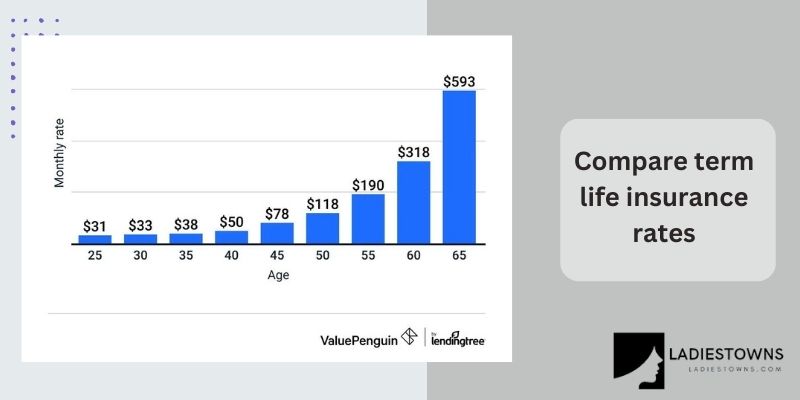

You have the opportunity to lock in a rate when you buy term life insurance for the level term length, which is often 5, 10, 15, 20, 25 or 30 years. Compare term life insurance rates During this time, the price of your insurance won’t alter. Only if you pass away while your insurance policy is still active will the insurer pay a death benefit. Your life insurance rates will increase if you select a longer term length.

Because term life insurance quotes are significantly less expensive than quotes for permanent life insurance, having coverage in place during the years when your family is most dependent on you for financial support is a cost-effective option. ladiestowns.com will provide for you some information about Compare term life insurance rates.

4 Best Term Life Insurance rates Companies

1. Pacific Life: Best Cost For $1 Million Term Life

Plan name

PL Promise Term

Minimum face amount

$50,000

Level term lengths available

10, 15, 20, 25 or 30 years

The low rates and excellent coverage features of Pacific Life contribute to its outstanding performance across the board in our examination.

- Low average cost of term life insurance among the businesses we looked at. offers incredibly low rates for term life insurance policies worth $1 million.

- There is a 95-year renewal guarantee on the insurance.

- Up until the age of 70, you can change your PL Promise Term coverage into a Pacific Life universal life insurance policy.

Cons

- You can only convert the term life insurance to a universal life insurance policy.

- Rapid death benefit

- Rider for term life insurance for children

- Premium rider disability exemption

2. Principal: Great For High Issue Age

Plan name

Term life

Minimum face amount

$200,000

Level term lengths available

10, 15, 20 or 30 years

The term life insurance policies from Principal provide affordable premiums and useful benefits. Notably, state authorities received zero complaints about its individual life insurance last year.

- affordable prices for term Compare term life insurance rates

- Depending on your age and health, you might be able to get term life insurance with up to $3 million in coverage without having to undergo a medical exam.

- 80 is the high issue age for 10-year term life insurance.

- Once the level term period is over, you can renew the coverage until age 95 (at higher rates).

Cons

- If you want the opportunity to convert the policy for the duration of the level term (or until you become 70), you must purchase the Conversion Extension Rider. The conversion period will be capped without the rider and be determined by the duration of your term.

- The $200,000 minimum face amount is larger than many rivals.

- Advance Death Benefit

- Extension for Conversion

- Reduction of Premium

3. Protective: Great For Long Level Term Length

Plan name

Classic Choice Term

Minimum face amount

$100,000

Level term lengths available

10, 15, 20, 25, 30, 35 or 40 years

The Classic Choice Compare term life insurance rates policy from Protective is distinguished by its competitive rates and excellent selection of level term lengths during which you lock in the rate.

- There are options for 35- and 40-year level term lengths. The longest level time span for several rivals is 30 years.

- When the level term period is up, the policy can be renewed up until age 95 (at increased rates each subsequent year).

- If you decide to convert the Compare term life insurance rates, you can select from up to 8 Protective permanent life insurance policies.

Cons

- Protective places stricter limitations on how the accelerated death benefit can be used than several rivals: Only 60% of the death benefit, or $1 million, whichever is smaller, is available to you. Additionally, your life expectancy must be no longer than six months, but many of your rivals choose 12 months.

- Rapid death benefit

- term life in children

- Unintentional death

- Removing the premium

- Optional income provider endorsement

4. Symetra: Best For Term life Insurance Rates

Plan name

SwiftTerm

Minimum face amount

$100,000

Level term lengths available

10, 15, 20 or 30 years

Symetra is a great choice for term life insurance shoppers because it has the lowest average Compare term life insurance rates in our review.

- the lowest term life rates we could find

- If you’re young and healthy, you can buy Symetra SwiftTerm online with immediate approval.

- Even after the level term period has ended, the policy can be renewed until age 95 (albeit at a higher cost each year).

Cons

- The 10-year term life’s maximum issue age of 60 is lower than its rivals’ maximum issue ages.

- The $3 million maximum face amount is also less than many rivals.

- Symetra doesn’t have a long history of proving its capacity to pay claims because it was only created in 1957, making it a very young corporation.

- If you are terminally ill, you are only eligible for an accelerated death benefit of up to $500,000 (or 75% of your death benefit, whichever is less).

- Rapid death benefit

- Benefit for accidental deaths

- Term life insurance for kids

- Removing the premium

5. Transamerica: Best For Buyers In Their 50s

Plan name

Trendsetter Super

Minimum face amount

$25,000

Level term lengths available

10, 15, 20, 25 or 30 years

Because of its exceptional rates and top-notch policy features that are offered for older ages, Transamerica’s Trendsetter Super insurance is deserving of consideration.

Transamerica’s Trendsetter LB term life policy is recommended for those looking for living benefits in a life insurance policy. If you have this coverage and you are diagnosed with a qualifying chronic or severe illness, you will be able to access funds from your own death benefit.

- Best average term life insurance prices among the businesses we analyzed for healthy consumers in their fifties.

- Young, healthy individuals purchasing Compare term life insurance rates won’t require a medical examination for up to $2 million in coverage.

- Buyers of life insurance who simply desire a small policy will find the low face amount of $25,000 appealing.

- The 80-year-old maximum issue age exceeds that of many rivals.

- The renewal age of the policy is 100, which is a greater age than many of the competitors.

- Up until age 75, which is also an older age than many other insurers give, you can convert the policy to permanent life insurance.

- Compare term life insurance rates prices are especially favorable for those in their fifties.

Cons

- Although you do get top-notch coverage features, rates were good but not the lowest among the businesses we studied.

- Rapid death benefit

- With Income Protection Option

- Premium Rider Disability Waiver

- Rider for Compare term life insurance rates for Children

- Rider for Accidental Death Benefit

6. AIG/American General: Great For Choices Of Term Lengths

Plan name

Select-a-Term

Minimum face amount

$100,000

Level term lengths available

10, 15, 20, 25, 30 or 35 years

When it comes to level term length options, American General’s Select-a-Term breaks the mold. The Select-a-Term policy from American General offers generally very affordable prices that will entice any purchase of Compare term life insurance rates in place of the customary rates.

- cheap prices for term life insurance.

- 80 is the high maximum issue age.

- Customers of term life insurance can choose a level term length of between 10 and 35 years, for example, 18 years.

- You must have a life expectancy of 24 months or fewer in order to employ the expedited death benefit rider; several rivals only require 12 months or less.

Cons

- After the level term expires, the Select-a-Term policy cannot be renewed.

- At age 70, the option to change the coverage to permanent Compare term life insurance rates is lost.

- Benefit for accidental deaths

- Rider for child life insurance

- Removing the premium